Understanding payer mixes allows dental groups to better manage their impact on the company’s overall revenue.

If your business is currently losing revenue because insurance reimbursements aren’t covering your costs anymore, you are not alone. Many expenses have steadily increased over the past couple of years and for some organizations, insurance plans haven’t increased in decades. An understanding of insurance mix and negotiation strategies is therefore an essential business tactic for any profitable dental organization.

Determining your dental organization’s optimal insurance mix is an important component of financial management. Insurance payer mix refers to the variety and proportion of different types of dental insurance plans. A practice negotiates and accepts specific insurance plans from each of its providers, and the corresponding distribution of patients is covered by each plan.

There are many insurance providers and coverage options available on the market today, including private dental insurance, government programs including Medicare and Medicaid, and self-paying patients. Each insurance type or plan covers a specific percentage of a practice’s patients. It is important to understand these payer mixes to manage their impact on the company’s overall revenue.

Dropping an insurance carrier can be a big decision for a dental organization, and it is important to understand the best steps to follow to be prepared for this type of strategic initiative. Planning for changes to the insurance mix is important, and below we’ll discuss how to effectively plan for the impact of switching plans, while empowering your organization to make informed decisions as to what’s best for you. Finally, we’ll cover how to conduct the necessary research and analysis to start the journey of optimizing your insurance mix, as well as a six-phase process that companies can utilize to evaluate insurance mix.

The insurance optimization process

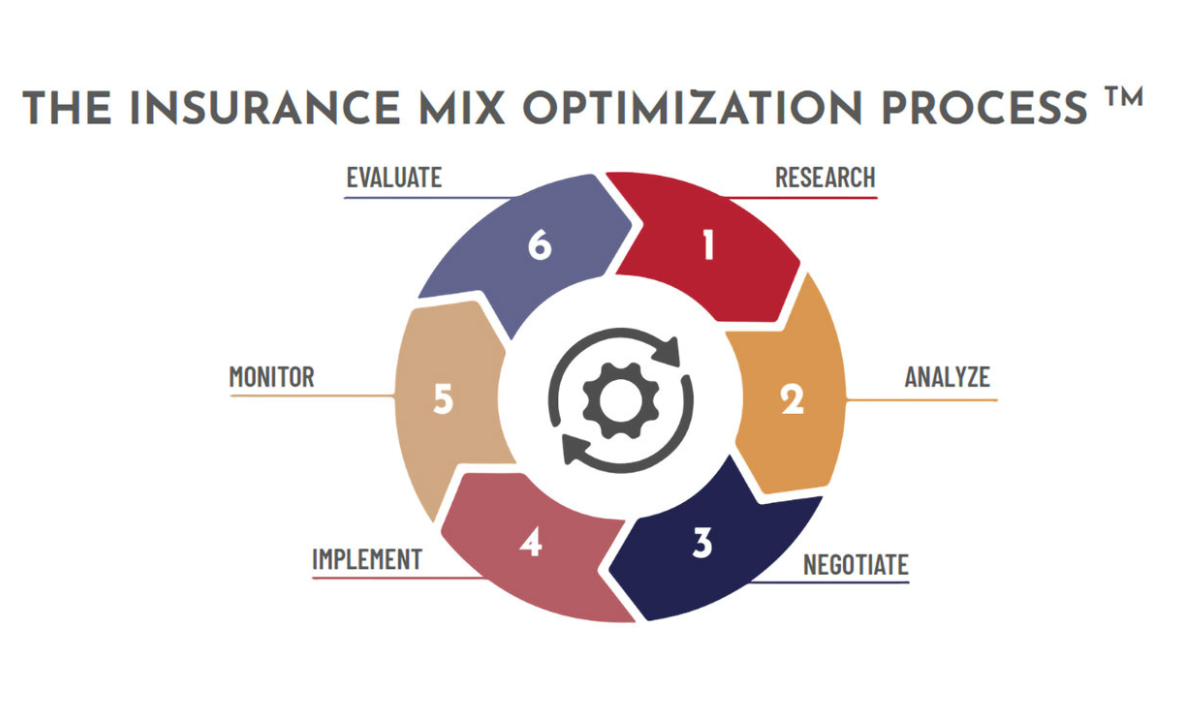

Dental leaders involved with insurance processes may find themselves negotiating fees, credentialing with multiple individual insurance providers, and trying to determine whether to add insurance companies or get rid of some. Wherever you are at, these steps for insurance optimization can be immediately actionable now or could be used to prep for the future of business optimization.

The ideal insurance payer mix allows a company to manage its patient volume, maximize care per visit, and make informed decisions. Costs are increasing for dental companies and their patients, and this impacts revenue. When a practice can’t increase visits because of capacity issues, such as provider issues or physical space, they often tend to drop some insurance plans because they don’t have the ability to see that number of patients. If you can’t increase visits because of capability issues, and you are also dropping the number of visits while not also increasing care per visit, then revenue will inevitably drop.

Increasing revenue is a simple formula: increasing visits or increasing patient care per visit. Understanding insurance payer mix serves to help a company make informed decisions about running their business.

Sometimes, insurance companies may be reimbursing less than what a company is paying them, so the company is losing revenue by continuing to network with them. This is where insurance optimization becomes necessary. The DEO Insurance Mix Optimization Process simplifies this planning into steps: research, analyze, negotiate, implement, monitor, and evaluate. Our focus in this article will be on the first three steps of this process.

The research phase

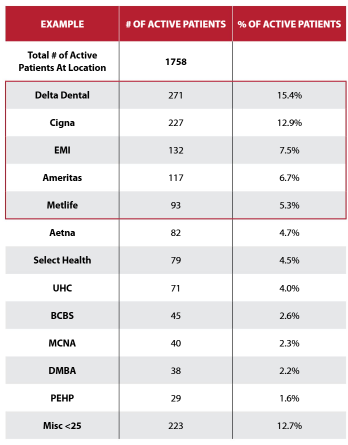

The first step within the research phase is identifying insurance payors by location. Start here by collecting a few pieces of information from your company’s practice management software. Organize data on all active patients, from up to the past 12 months. If your organization has multiple locations, find this information separately for each location. The reason for this is that you have different patient demographics per practice, and even if your organization takes all the same insurance plans across the board, you want to understand which plans are your highest patient base for each location. This way, you know which providers you need to negotiate with, which ones you may need to drop, and what your potential negotiation tactics are going to be. If there is a payer that a practice is struggling with and they’re not currently on the radar, it’s an easy decision to make to let go of that payer, especially if they only are supporting a few patients.

Step two of the research phase is to take the active patient data and document key codes and fees. Then, take your top revenue-generating codes from the past 90 days. In step two, we only go back 90 days because a practice may have different procedure codes that change based on whether providers come in or change. Having this information based on a shorter period allows practices to understand which of their patients they are actively seeing.

Leaders should then take the top revenue generating codes out of the practice management software for all locations (as they will all stack up differently). This piece is important because an insurance company might come back and have a 300 percent increase, and when you know your top codes, you are able to pay attention to them during negotiations and make sure to compare fee schedules compared to top codes.

Step three of the research phase is to add in your organization’s current plan fees. Once you do this, you can see the cost of the top generating codes, and you can now notice details, such as when your organization may need to cut a provider if a top generating code is losing money every time.

Fee schedules should be easy to pull out if they are already in the organization’s practice management software. If not, they can be pulled from the insurance report and entered to better understand how each insurance backs up against each other.

Adjusting the usual, customary, reasonable (UCR) fees using a fee calculator is step four of the research phase. Once UCR is determined, add the organization’s adjusted UCR to your scorecard to understand reimbursement to UCR. UCR is a tactic for insurance companies to conduct insurance reimbursements and should never be a fee required for your patients to pay – dental organizations are required to increase UCR to increase insurance reimbursements, so that patients don’t have to pay these fees. To make the decision to prioritize an insurance provider, determine what is too low for your organization’s UCR fees first.

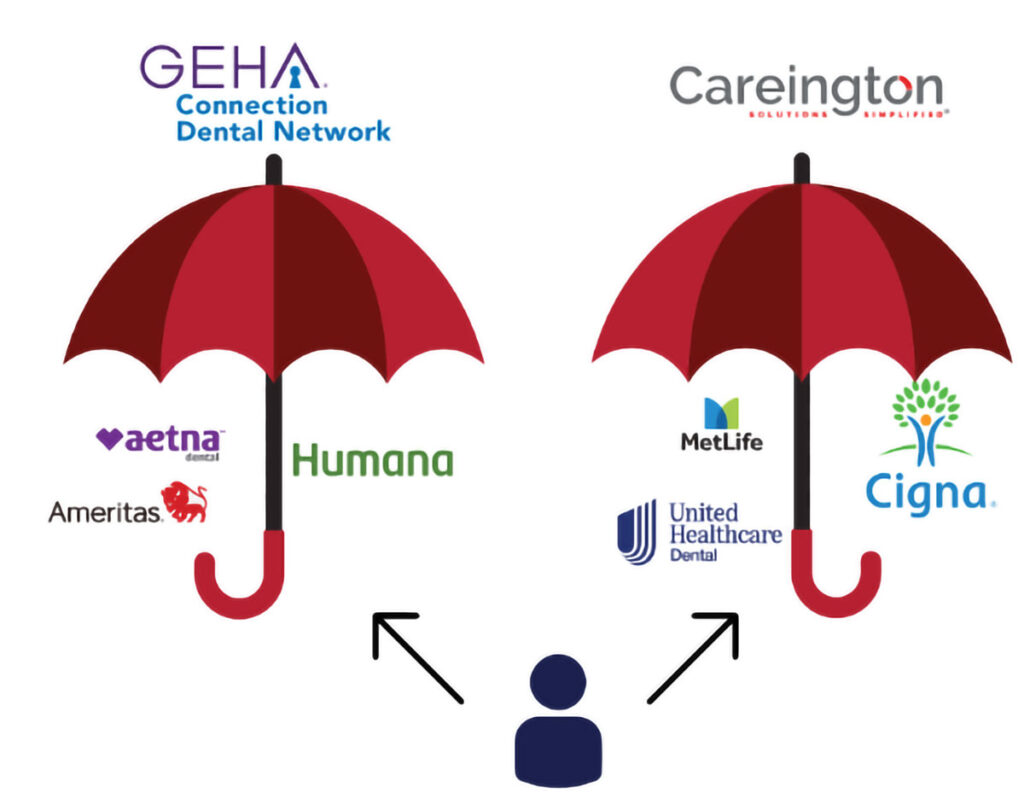

Step five of the research phase is to add in fees for top 25 codes for umbrellas/ TPAs (third party administrators). This means that instead of having a contract with multiple insurance companies directly, contractors are instead seen under simplified umbrellas. These umbrellas allow dental organizations to have a higher overall reimbursement rate and streamline communications with each insurance company.

If insurance providers are organized into umbrellas, dental organizations will not have to negotiate with all these plans separately, they can simply negotiate with one umbrella at a time. Under an umbrella, leaders can see which insurance companies need to be at the top of all insurance providers. Naturally, a higher percentage of patients will be under the top four insurance plans, making operations much easier.

Analyze and negotiate

Step two of the Insurance Optimization Process is to analyze, and here organizations should compare fees for individual payers against umbrellas. Analyze the data collected in the research phase and determine what it means for your business overall. In the analyze phase, decide what you are going to do with the insurance numbers found in the previous step. Make sure you go back and forth with the insurance companies to fully understand the numbers that you are working with.

In the negotiation phase, step three of the Insurance Optimization Process, leadership decides whether to negotiate individually or to sign up with a TPA/umbrella. Option A within this step is to negotiate with individual payers, considering first if your top payors aren’t covered under a TPA, or if your top payers’ fees are higher than your TPA’s fees. Option B is to sign up with a TPA/umbrella, and factors to consider here are if the TPA covers several of your current top insurance payors, and if the TPA’s reimbursement rates improve your care per visit significantly. Make sure you are tackling the top payers first to get the greatest revenue increase.

In the implementation step of the Insurance Optimization Process, step four, bring the insurance decision back to the team level and evaluate why you are trying to increase insurance reimbursements, why you’re trying to optimize, or why you are trying to drop plans.

In the monitor step, step five, make sure to go back and evaluate if insurance payors paid what they said they would, and double check that you are getting paid correctly. In the evaluation step, step nine, determine how often you can renegotiate; dental leaders are often surprised at how often insurance providers will renegotiate plans.

The Insurance Optimization Process will serve to simplify negotiations with insurance providers to get dental companies on track to earning more revenue. Begin by identifying your top insurance payers, document codes, don’t be scared to adjust the UCR, find out if fees for an umbrella if this route will be better for you, drop them in the patient management software and analyze them, and then decide if you want to negotiate individually with providers or want to sign up for umbrella plans.