How dental practices can better manage their collections processes.

Revenue cycle management (RCM) is the process of managing collections. The collections process spans from the moment of the first initial visit when the patient comes in until the practice collects patient balance.

This is how your practice gets paid. Most businesses – the lucky ones – get paid at the time of service. But not medical and dental. The process for healthcare providers can extend out into a 7 to 11-step process.

During a panel at a recent DEO Summit, Jordyn Butcher, DEO Community Manager, and Jenny Fetty, VP of Dental Sales, Medusind shared insights into how to better manage dental practice collections processes. The following are several insights they shared.

The process

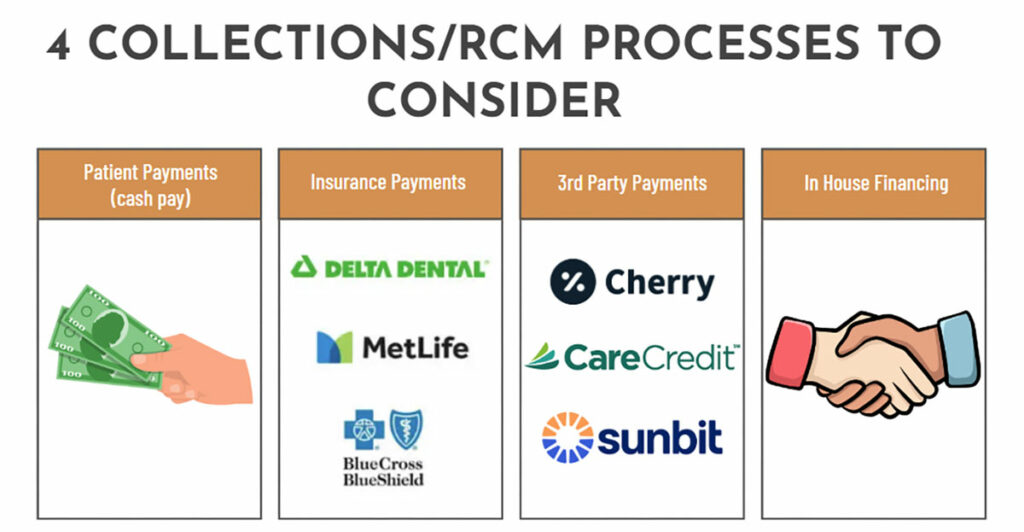

To develop a collections process, start by thinking about the different ways that cash comes into a business. This includes patient payments, insurance company payments, or third-party payors, who are charging the practice a fee to pay for the service upfront.

Each of these payors is a different part of the RCM process. If a practice doesn’t already have a process in place that holds associates accountable for each step, it can be easy to lose track and revenue can slip through the cracks, which is why correctly managing RCM is important.

A dental practice may not have a singular associate that is responsible for the RCM process, but instead assign one or more employees to be accountable for this responsibility.

The first step in the RCM process is to input patient data including patient information, demographic information, and insurance, and make sure that all this information is correct.

Second, denote which services a patient is coming into the office for, whether it is initial services, a new hygiene, a comp exam, emergency appointment, etc. The service that is performed may change when the patient comes in. If there are changes to the services provided to the patient, the team should be informed so that it can be corrected in the practice management software before the patient leaves.

The third step is the patient portion elected, and this is where the patient co-pay needs to be collected.

The fourth and final step is sending the patient a clean claim. All the steps prior must be done in the correct order for the claim to be considered “clean” and sent.

In an ideal world, that claim is sent to insurance, insurance pays, the patient payment or the payment, and the adjustment is applied to the ledger, and you’re paid. But that’s a lengthy process in an ideal situation for you to be paid on one database.

Oftentimes, dental practices experience claims that aren’t sent clean, or they’re not always accepted. Sometimes they’re not paid right away, or the claim comes back as denied. This constant back and forth can be overwhelming for a dental office, so it is necessary to introduce a process and steps.

The first step after a claim is denied is to have an appeal letter ready. This can be a template with basic information that will be standardized and then filled in for each patient. The appeal letter includes patient information, service information, any supporting documents, and a doctor’s signature. The purpose of the appeal letter is to get the patient to pay their outstanding dues for services. A practice should continue to send appeal letters until a patient pays.

Creating a process makes this less scary for your dental team. It’s still a heavy lift, but with the right people and process in place, the job will get done. Once the claim is paid and billed to a patient, then the process is complete.

Who does what?

There are a lot of resources that teams can use to focus on great phone calls and conversion rates. These processes can also be outsourced. This doesn’t mean that teams need to outsource everything. You might look at your practice and determine you’re having a pain point with insurance verification and outsource that one piece. All organizations are different in how they structure their RCM teams. Many choose to outsource the aspects of the business that require teams to frequently use the phones, such as insurance verification and claim servicing.

It can help those in charge of RCM processes to have a separate space or office where they can fully focus on the financial aspect of the business while others focus on scheduling treatment and customer care.

Key reports

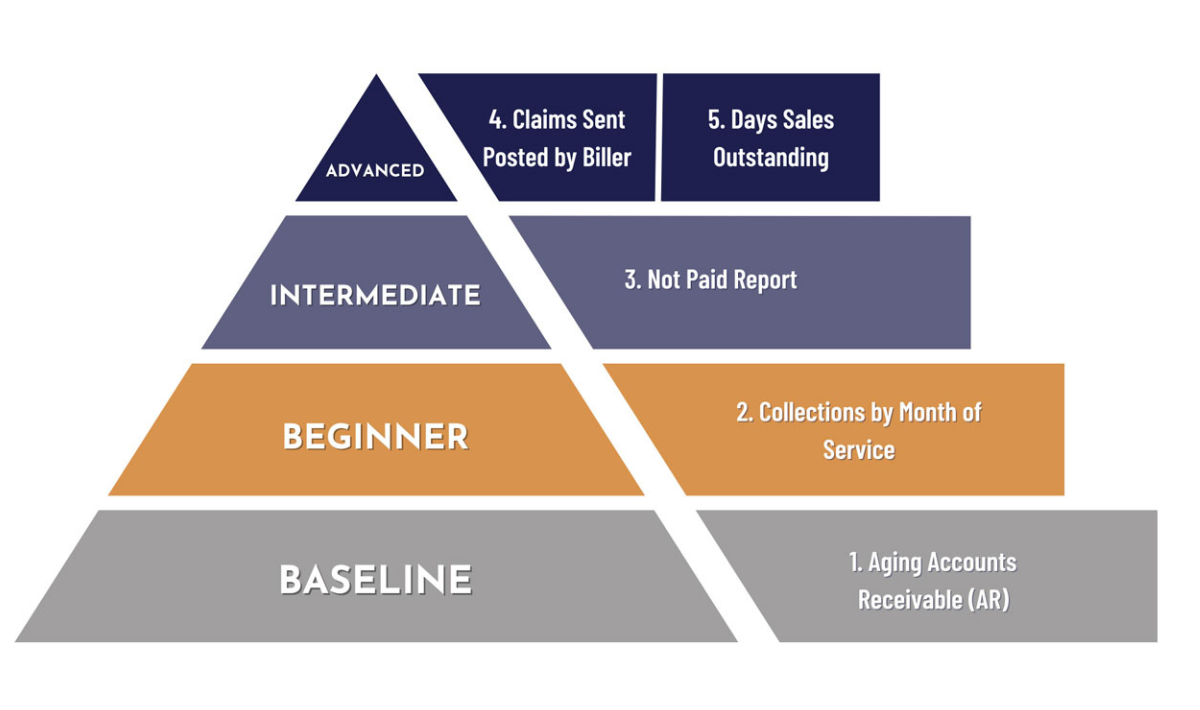

The following are five reports that DEO has identified as critical to RCM:

Report No. 1:

Aging Accounts Receivable.

Who owes you money and how long it has been since they were supposed to have paid you (sort by patient name or insurance company with the amount owed). The purpose of this report is to be able to follow up and collect on money owed.

Report No. 2:

Collections By Month of Service.

Amount of a month’s production collected. This report analyzes whatever you haven’t collected and helps you figure out why you haven’t collected 100%

Report No. 3:

Not Paid Report.

Amount not collected for a given month’s production. The purpose of this report is to clearly identify opportunities for additional collections by customer pay, insurance, and payment plans.

Report No. 4:

Claims Sent and Posted By Biller.

The dollar amount of claims sent out and the amount posted by each biller in a certain time period. This shows you the productivity and efficiency of billers; to help you identify when the constraint is the org chart (not enough people to bill out) or skill set; to reveal operational inefficiencies

Report No. 5:

Days Sales Outstanding.

How long is it taking for an insurance company to pay you on average? This helps you compare different insurance companies and see whether your AR report is within the typical window for that insurance company.

Collections are the foundation of a business’s revenue. It allows dental leaders to understand the cash flows within their practice and make business decisions based on those numbers. Prioritizing revenue processes and making sure that certain associates focus on RCM process responsibilities will help a practice to collect revenue and prevent earnings from slipping through the cracks.