Membership plans drive patients to commit to care, trust your practice, and feel financially savvy.

In the 1960s, dental plans allowed a maximum annual benefit of $1,000. More than 50 years later, the average plan still allows $1,000. Dental practices deal with annual limits, pre-approvals, waiting periods, claims denials, and paperwork, and on average, PPOs reimburse 66% of office fees.

PPOs don’t work for dental practices. Insurance reimbursements are low and lagging, and they haven’t kept up with labor cost increases. Revenue cycle management and collections come from four different processes in practices – patient payments, insurance payments, third-party payments, and in-house financing.

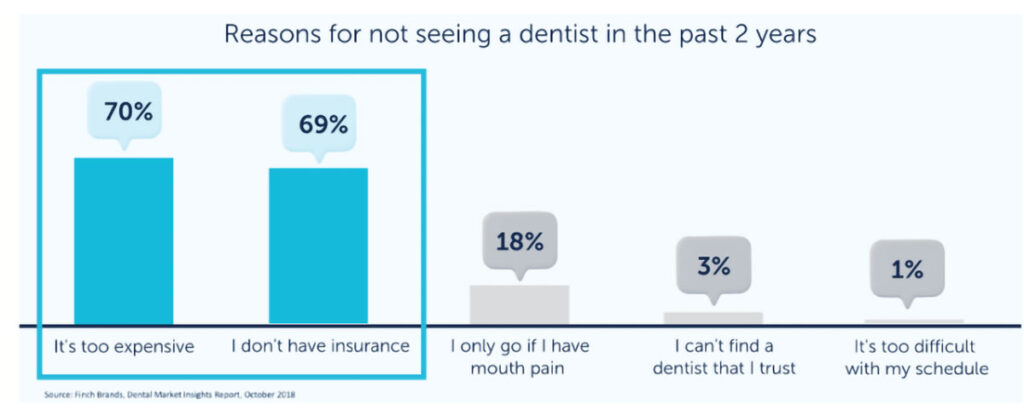

About 100 million people in the U.S. don’t have dental benefits, and cost and coverage are the primary reasons uninsured patients avoid visits and treatment. Over 75 million people lack access to any dental benefit and the rest have recently been disenrolled from Medicaid, according to the CareQuest Institute for Oral Health.

Membership plans

Creating membership plans is the solution. First, patients commit to care, trust your dental practice, and feel financially savvy. Second, patients complete two to three times more hygiene reappointments and finally, patients accept more care as 75% of treatment originates in hygiene.

This is really when dental practices say they want to drop PPO insurance and increase their revenue. They want the patients to pay more directly. But how should practices go about dropping insurances and avoid the pitfalls of poor messaging and strategy?

Practices need to first assess some key indicators for whether a membership plan could be helpful. These include having a large number of uninsured patients, being at capacity for scheduling, and if membership benefit plans are better than the PPO benefits for some of your patients.

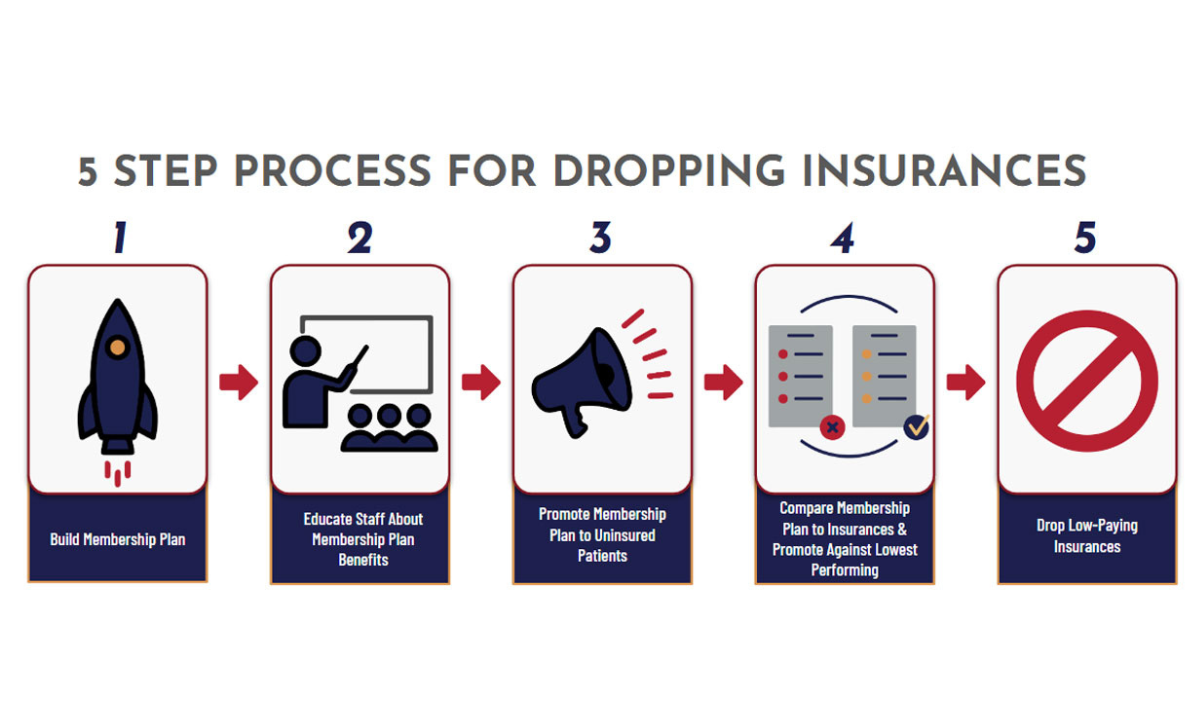

There are five steps for preparing to drop PPO insurances. They are:

1. Building a membership plan.

2. Educating staff about membership plan benefits.

3. Promoting the membership plan to uninsured patients.

4. Comparing the membership plan to insurances and promote against the lowest performing.

5. Dropping low-paying insurances.

Key tips for building a membership plan include making sure it’s profitable by achieving a targeted profit margin with the right mix of coverage options for your practice. Keep it simple by reducing practice administration by dropping poor performing PPOs. Make it smart through informed coverage plan decisions that align with your goals. This may include staying with unprofitable PPOs that provide a community service. Finally, make sure it’s managed by tracking performance and manage coverage options so you can continually optimize practice production and profit.

Communication is key in helping your team understand how low contract fees can negatively impact profitability. It’s also key in informing your patients about the changes. Provide ample notice to your patients, explain your reasons, offer alternatives, educate them and provide them support. Don’t spring the news on them unexpectedly, play the blame game, dismiss concerns, overpromise or neglect communication.

This is your beta testing before you drop insurances. If your team isn’t good at converting uninsured patients to membership plans, they might need more training or better scripting. But this is your opportunity to iron out any difficulties in communication before dropping insurances because uninsured patients should be your team’s easiest conversions.

Make comparisons side by side to create a win-win. Don’t leave the unknowns out there. Explain to your covered patients why a membership plan would be better for their out-of-pocket costs. Start with the patients with the lowest paying insurance plans and show them you have something better.

Next steps

Start pulling together the information on the number of your uninsured patients. What would happen if those patients started accepting more treatment? What if your practice got better at treatment coordination and giving those patients a solution?

Walk through the process. Look at the lowest paying insurance and start to climb the ladder. Identify if you are ready to act. Remember, you need a large number of uninsured patients, you’re at capacity for scheduling and membership plan benefits would be better than PPO benefits for some of your patients. Then, follow the five-step process for dropping PPO insurances.

Have a community liaison on your team. Someone who is fluent in your membership plan. They can go to small businesses in the community and talk about your practice and plan. If you’re a large practice, people may view you the same way they view the insurance companies. So, you need someone who will build trust in the community.

When your team is on board and sees the financial benefits for the practice and the bonuses they can hit, make them your greatest ambassadors and assets for your membership plan.