Get the most out of your financial team and financial statements.

Financial statements are the foundation of reducing costs, getting out of the chair, and buying a new practice. So, how do you get them right? With all the chaos to manage as leaders, financials are one thing you can control to make sure they are accurate and timely.

“Part of executive leadership is knowing what we shouldn’t tolerate anymore,” said Emmet Scott, DEO Head Coach. “One of those is financials that aren’t accurate and timely. This is an area to be demanding in and more idealistic about. You can say, ‘no, I need them this way and I need them by this time.’”

Moving from an entrepreneur to an executive means becoming educated on the structure of an executive team with a CFO and a COO and their responsibilities. You are the CEO and the executive over all other executives.

“You need to know what their positions are supposed to do,” Scott said. “Getting organized creates alignment around financials and gives you the foundation to know how to grow your business.”

Scott said you must employ constraints on your financials. If the benchmark is no more than 15 days, then it’s no more than 15 days. Period.

But once you get them, do you actually understand them? How well are they organized? Are you bringing the right issue to the right person? Do you know the right question to get the right answer?

“Many think because the accountant does their taxes, they should bring all of their business strategy to them,” Scott said. “And they don’t actually know how to hold them accountable or what questions they should be asking them.”

The financial roles

An organizational chart of financial leaders should begin with a CFO and flow to a controller and an accountant/CPA and down to a bookkeeper.

An accountant plays a more comprehensive and analytical role in managing the financial aspects of your organization through tax filing, auditing and compliance.

“Your accountant is really your tax accountant,” Scott said. “They aren’t even your tax strategist, even though we would love for them to be. But most accountants look backward, and tax filing is their lane of confidence.”

Bookkeepers provide a transactional level of accounting for your team, inputting data and making sure every bank transaction makes it onto your financials. It’s a critical role for the foundation of your books. They record financial transactions, manage accounts payable and receivable, reconcile bank statements, process payroll and conduct general financial administration.

“Junk in, junk out,” Scott said. “If you’re putting supplies in marketing and marketing in supplies, it’s going to be hard for you to do an analysis of where you’re at as a business.”

“As you grow your business, you probably have some sort of hybrid controller/CFO,” Scott explained. “They execute two functions – they organize your financials and they put controls in place.”

Controllers are higher-level accountants. They focus on managing day-to-day financial operations and their role is to ensure financial discipline and help optimize profitability. They manage a team of accountants across multiple locations that provide financial reporting, internal controls, and compliance.

They improve the chart of account allocations and ensure accurate data and timely reporting.

“If you have a good controller, your CFO and tax preparer have easier jobs because they’re handed finished products,” Scott said.

Your CFO handles the strategy. They focus on financial management and strategic decision-making. They will look at performance, cash flow, buying new practices, and more through:

- Long-term financial planning and strategy.

- Risk management.

- Capital structure optimization.

- Budgeting and forecasting.

- Financial relationships and partnerships.

- Investor relations.

- Team leadership and development.

Finance includes tax accounting, tax strategy, managerial accounting, and strategy. Best practices for effectively working with your finance team include meeting regularly, reviewing reports, setting clear expectations, reviewing assumptions, and managing risk.

“For example, your underlying assumption might be to grow by 10% each month,” Scott said. “But whatever your underlying assumptions are, decide whether they will work or not.”

| Best Practices for Working Effectively with Your Finance Team • Meet regularly • Review reports • Set clear expectations • Review assumptions • Manage risk |

The P&L statement

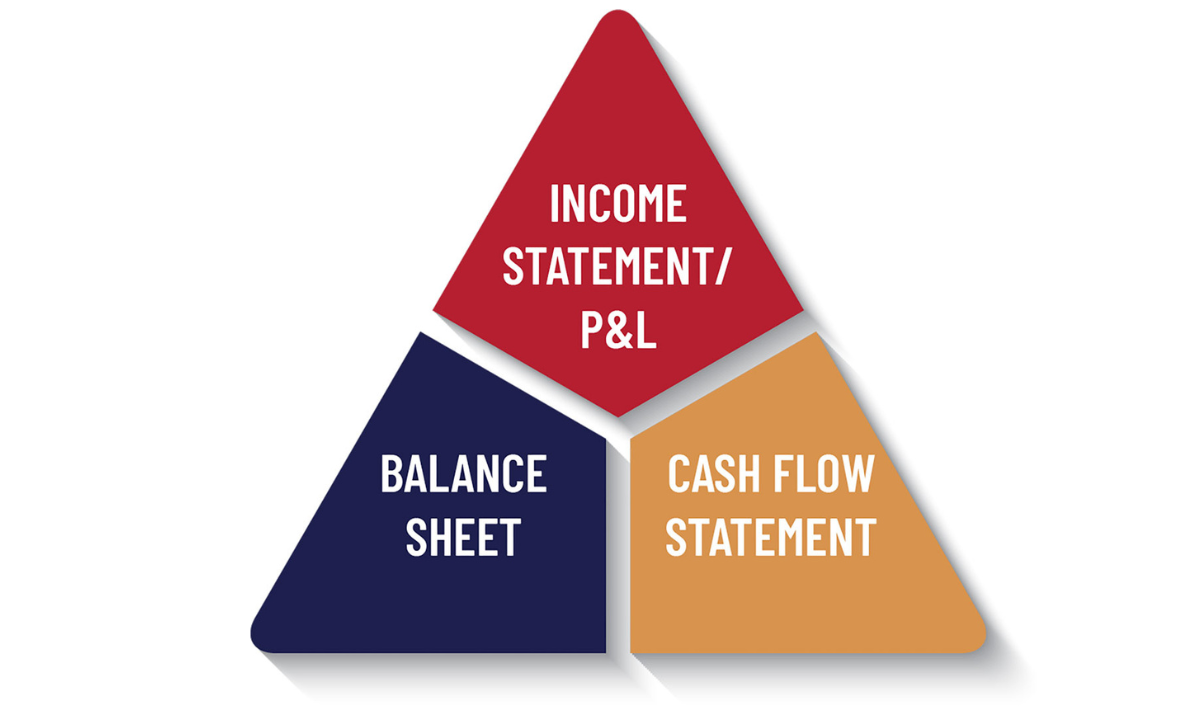

The three most essential financial reports are your income statement/P&L, balance sheet, and cash flow statement. Your P&L statement summarizes your revenues and expenses for a period of time, as well as your operational activities, and can view them in terms of production, known as accrual, or dollars in and out, which is cash.

“The better you are at organizing that period of time, the more clarity you get,” Scott said. “Eventually as you scale, you need more clarity of what your true costs are.”

Moving to accrual accounting from cash accounting is just a matter of when cash accounting isn’t working for your business anymore. It’s less complicated and less expensive, but eventually it won’t work after scaling your business.

“The P&L statement is my favorite because it shows each month next to each other, or it can be each practice next to each other and I can see trends,” Scott said. “I can see if something feels off. Being able to see the percentages and dollar amounts next to each other allows me to quickly identify operational opportunities.”

Accrual-based organizations can see production and any adjustments based on how much they think they are going to collect. But most organizations are cash-based and getting their cost of goods sold (COGS) organized gives them about 90% of the benefit of their P&L statement, according to Scott, and these four things move the most with revenue:

- Doctor pay.

- Hygienist pay.

- Supplies.

- Lab fees.

“These are the most variable expenses,” he said. “If I do $100,000 or $500,000, how much does my rent move? None. But how much does my doctor pay move? Dramatically. Production should be moving with your hygiene costs and your supplies and lab fees.”

The percentage on the P&L statement is powerful because it tells you what the cost is of having a dollar go through your system.

“I can do some really quick math on practices,” Scott said. “I can do this when I’m looking to buy. I can do an analysis if we add another $10,000. I can take the fixed expenses and divide it by the gross profit number and know how much my break-even point is.”

If it’s multiple practices, you can ask why one practice is performing better than another practice. Is it supplies? Is it doctors? These reasons start to reveal themselves.

It’s critical to lock down your cost of goods sold and your variable costs, so you know what’s left for your practice-level expenses that are broken into four buckets:

- Employee costs like dental assistant salaries, front office staff wages, payroll taxes, health insurance, and total employee benefits.

- Marketing costs.

- Facilities and equipment costs.

- Administrative overhead costs.

“There is some variability in these fixed expenses like overtime, but you can’t say to staff it’s going to be a slow week and cut their work hours to 20 hours,” said Chris Foy, DEO’s CFO.

This all equals net operating income. Revenue and collections come in with variable expenses and fixed expenses to equal income from operations.

Other expenses and corporate expenses like general marketing, operations manager, clinical operations, credentialing and compliance, and IT, finance, and accounting fall under net operating income in the chart of accounts.

“This is where I would put individuals who are not directly contributing to the production of the office,” Foy said. “Maybe they are spread amongst several offices. And by having that under net operating income, I can look across practices and compare apples to apples.”

“Finally, I can add in my taxes, depreciation, amortization, which I end up adding back in order to get to EBITDA,” he said.

There are four buckets that everything falls under on the chart of accounts:

- Revenue.

- Cost of goods sold.

- Practice expenses.

- Other expenses.

“Everyone should be organized in their chart of accounts this way,” Scott said.

Are you missing certain categories or buckets? Do you have sub-accounts in the wrong bucket? Do you have expenses going into the wrong sub-account?

“Think about which categories you are missing,” Scott added. “Update your chart of accounts if necessary and ensure you are receiving your financials timely and accurately.”