Before you get any ideas about starting a DSO of your own, let’s talk about the real legal and accounting ramifications and why this structure may not be the best option for everyone.

By Emmet Scott, Partner, DEO

Disclaimer – This article does not, and is not intended to, constitute legal or financial advice; instead, the frameworks and tactics are for general informational purposes only. Readers should contact their advisors and seek relevant counsel prior to acting on the basis of information in this article.

Throughout the dental industry, many people are exploring the option of forming Dental Support Organizations (DSOs) to streamline operations and achieve economies of scale. Many people think that starting a DSO is what they need to do to bring on clinical partners, buy new locations, look better to a bank, or make their financial allocations easier across practices. Unfortunately, these are all common misconceptions, and plenty of unsuspecting owners have gone down the DSO path only to eventually realize that they’ve made a $30,000 mistake.

Additionally, industry jargon can get confusing, as a “DSO” can refer to a philosophical structure or a legal structure.

Philosophically, a DSO refers to the culture, support structures, and internal infrastructure that are put in place to support the practices within the organization. This includes things like standardized protocols, training programs, and shared resources. The goal is to create a cohesive and supportive environment for all practices within the DSO.

The legal structure of a DSO refers to the entities, accounting processes, and compliance measures that are necessary to establish and maintain the DSO. This can include setting up separate entities for the DSO and each individual practice, implementing complex accounting systems to track financials, and ensuring compliance with applicable laws and regulations.

While the philosophical structure is crucial for the success of a DSO, in this article I am going to dive into what a DSO is from a legal structure perspective, because without that in place, a DSO is simply just a concept or idea.

There are essentially two parts to truly being a DSO. The first gets a lot of attention, and is the actual legal structure, which includes things like your entity structure and management contracts, while the second, and often overlooked, is the accounting management that needs to be done on a regular basis afterwards.

Legal setup of a DSO

To keep things simple, I’m going to generalize some frameworks you can use when talking to your advisors. For the actual legal structure of your DSO, there are two main options.

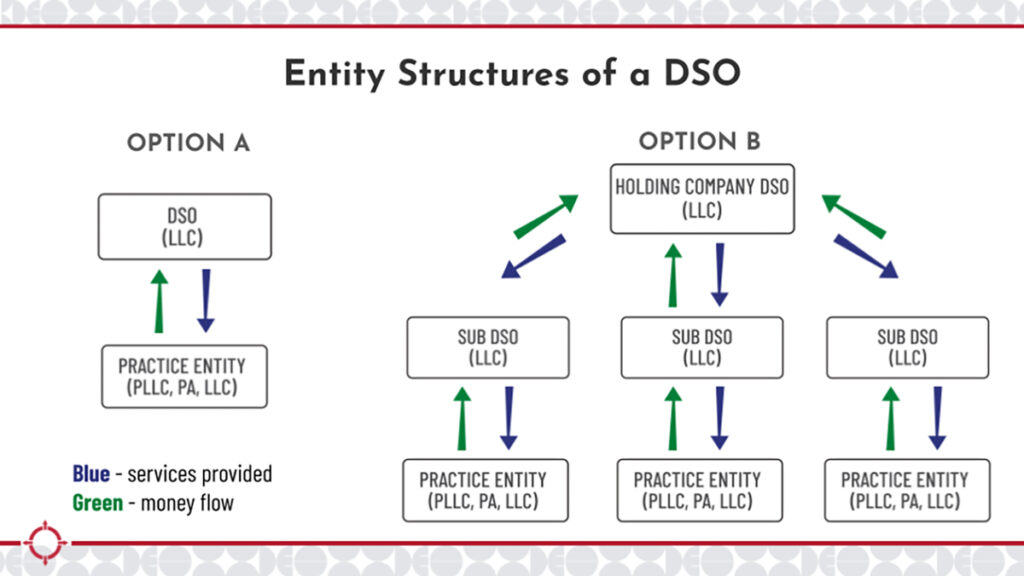

Option A, you have some kind of practice entity. Most states only allow dentists to own the practice. When we talk about setting up a DSO from a legal structure, we’re setting up an LLC that we’ll call our DSO, and we’re going to utilize that as a separate entity from the practice. The DSO is going to provide services to the practice, and the practice is going to pay dollars up to the LLC. That’s the basic structure.

Option B is a little more sophisticated. In this scenario, you have multiple practices, and possibly sub-DSOs, because you want to break equity between different associates or non-dental partners. This is a common option when you don’t want to give associates or non-dental partners equity at the top because you’re going to be opening multiple practices. You want them motivated at the practice level.

You’ll notice in Figure 1 that there are arrows going in both directions. The money flow goes up, while the licensing and management agreements flow down.

Management Contracts

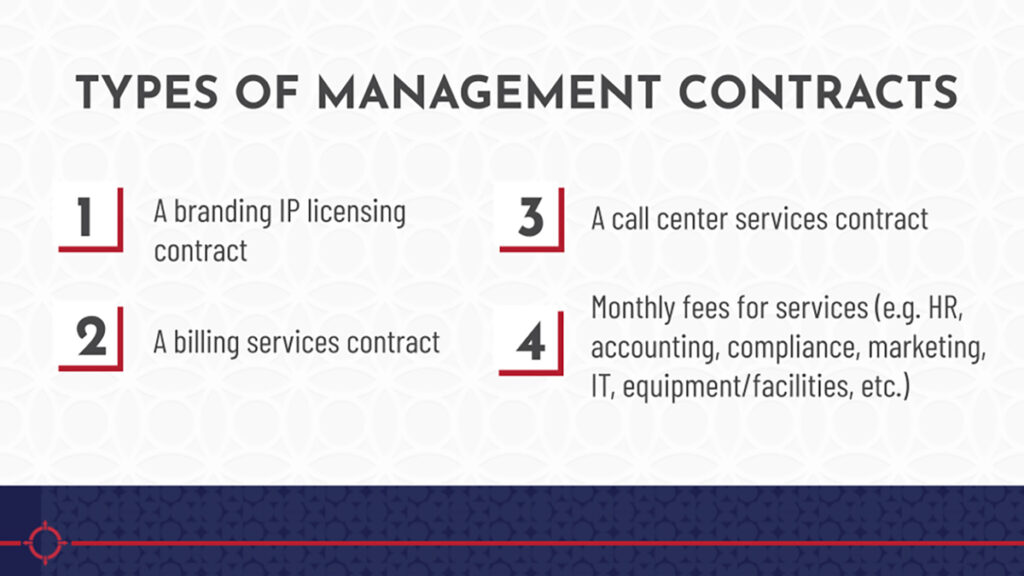

Management Contracts are a series of contracts, depending on state law, that legally allow you to move practice profits up to a DSO or Sub-DSO entity. These are needed because of the Corporate Practice of Medicine Act, which doesn’t allow you to just profit share over to an LLC. You must have a real reason that you’re moving that money over to an entity, especially one that might have a non-dentist in it. You must justify why you’re moving those dollars up. Every state law has different rules around that. Some states say you can’t use a percentage of revenue. Though I’d say it is fine, typically if it’s for billing services or call center services, just because those have been established as a percentage of revenue cost. But other things like HR services your DSO provides, IT services, and accounting services down to the practice, those are typically done on some kind of fixed fee.

There are different types of management contracts that are used as ways to move the money up to the DSO (Figure 2). You can have a branding IP licensing contract, or billing services, call center services, etc. You could have monthly fees for all these different parts. Maybe the DSO owns the facility so they’re charging rent to the practice. All of these move the money up to the DSO.

Accounting management of a DSO

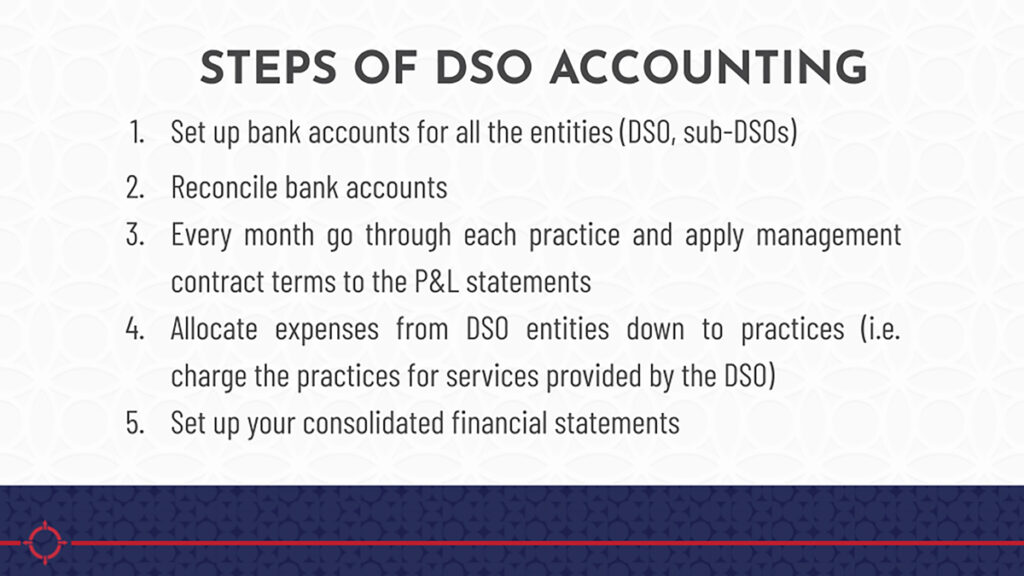

Accounting management doesn’t typically get as much attention as the legal structure, but this is where the complexity really comes in. There are several steps involved:

- Set up bank accounts for all the entities (DSO, sub-DSOs)

- Reconcile bank accounts

- Every month go through each practice and apply management contract terms to the P&L statements

- Allocate expenses from DSO entities down to practices (i.e. charge the practices for services provided by the DSO)

- Set up your consolidated financial statements

With every one of these LLCs, you have a different bank account, and each bank account will have to be reconciled by moving the money around. You have all these entities to manage with multiple locations and bank accounts. I can speak firsthand to this. At our DSO we had 77 locations and something like 250 bank accounts, so just imagine what that takes on the accounting side. You must do all of this in a compliant way. Remember, we’re talking about regulations.

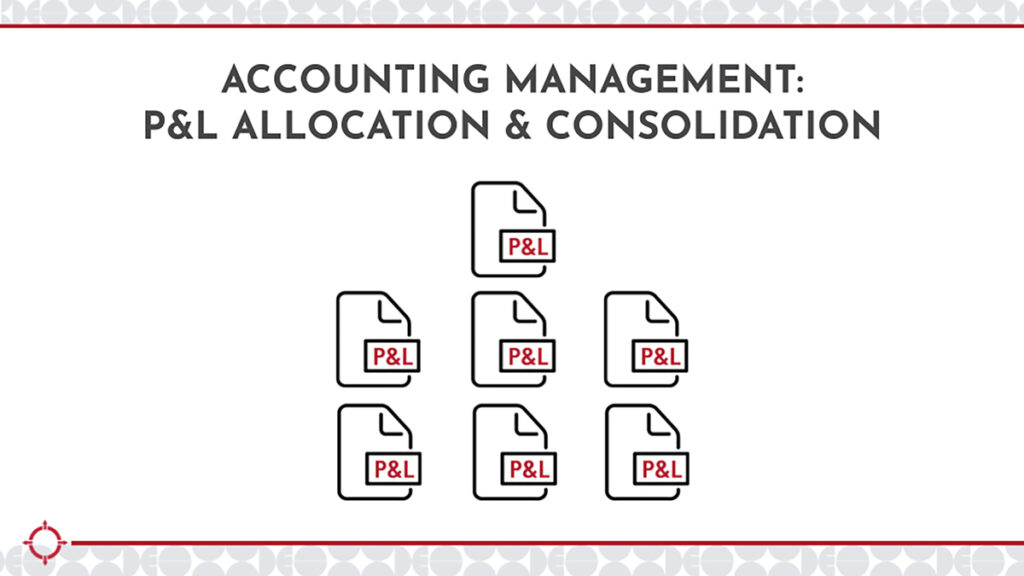

For each of these entities, you now have the issue of profit and loss (P&L) statements. So you might say, “Hey, I wonder how Practice A is doing?” Before you could just run a P&L for Practice A, but now you have management contracts pulling money out, or centralized call centers that you’re allocating down. You must combine the sub-DSOs at the practice level in order to figure out how this practice is doing, and QuickBooks doesn’t do this naturally.

When not to set up a DSO

The following are common reasons that dental leaders mistakenly believe a DSO structure is required:

Reason No. 1: You want to bring on a clinical partner and give them equity. We’ve already established that clinicians can own practices. You can make them a partner at the practice level; you don’t need to do this Day 1 if you want to retain an associate and give them equity. You could also give them profit-sharing instead of equity, establish a certain percentage the practice needs to make (e.g. 15% profit), then say everything over that you’ll share 50-50.

Reason No. 2: You want to create a DSO to buy more locations. You don’t need a DSO structure to buy more locations.

Reason No. 3: If you set up a DSO, the bank will think you’re more sophisticated. The bank might be cutting you off and denying funding for additional locations, so you think that you need this structure to convince them. Banks will see a DSO as complicated – shuffling around money – and they want to see hard assets. Banks start looking at cash flow and ask you to personally guarantee the loan based on your ability to produce income, but if you have a $10 million ask, they may say you can’t work your way out of that. Setting up entities and moving cash around looks more complicated to them. Banks have business owner lending and corporate lending – dentistry sits on the business-owner side. Corporate lending is very complicated, and you don’t want to move there too early by setting up a DSO.

Reason No. 4: You have a regional clinician working in multiple practices and want to set up an LLC to move her payroll up. If you have employees who are being billed out of a certain practice but they’re serving multiple practices, you might think that by setting up a separate entity you can allocate these employees down to different practices. You can do this from the practice entity too – they’re working in Practice A, we’re going to allocate to B, C, D. This is nothing compared to DSO complexity. These allocations aren’t regulated, and you can mess them up without being audited. It’s nice to practice doing these allocations because you’re not under the Corporate Practice of Medicine regulatory compliance.

When the DSO structure makes sense

A DSO structure should only be used to bring in non-clinical investors. All other reasons aren’t worth it.

Maybe you need to bring in non-clinical executives who will require equity. They might be offered equity from other industries, so to compete, you need to do this.

Or, you need to bring in a private equity investor. Maybe you maxed out what you can do with the banks. You want to cash out and take some chips off the table, but another dentist won’t be able to pay you for what you’ve built, so you need to bring in money from non-clinicians who want an equity position. In this scenario, the DSO is the only way to do this.

Whatever the case, consider the cost. Is it worth doing everything I laid out to give this individual equity? I would start off by trying to figure out another way, perhaps some profit sharing, phantom equity, etc., because the cost of getting this structure in place is going to be expensive. However, if you bring in a CFO who will be the one managing all of this, maybe it’s worth it.

Achieving your goals

To review, establishing and maintaining a Dental Support Organization (DSO) involves navigating complex legal and accounting structures due to the nature of the business model. The legal structure of a DSO typically involves setting up a separate entity, such as an LLC, to serve as the DSO. This entity will provide support services to the dental practices within the organization.

To ensure compliance with state laws and regulations, it is important to consult with attorneys who specialize in healthcare and dental law. They can help navigate the legal complexities and ensure that the DSO structure is set up correctly.

In terms of accounting, the DSO will need to establish a system for financial management and reporting. This includes allocating expenses and revenues between the DSO and the individual dental practices. It may involve setting up management contracts and determining appropriate fees for services provided by the DSO.

These legal and accounting considerations can be time-consuming and expensive. It requires working closely with legal and accounting professionals to ensure compliance and establish effective systems. Additionally, ongoing maintenance and monitoring of the DSO structure and financial management can also be resource-intensive.

It is important to note that the complexity and expenses associated with establishing and maintaining a DSO are primarily driven by the need to involve non-dental investors or partners. If there is no need for external investment, the legal and accounting structures can be simplified.

As you can see, setting up a DSO can be complex and may not be necessary for achieving your goals. It’s important to carefully consider the specific needs and circumstances of your dental practice before deciding to establish a DSO.

While I am very “pro DSO” from a philosophical perspective, the legal structure may not necessarily be the best progression for many growth-minded owners, and I’ve seen so many people spend a lot of money establishing the structure, to then have this cost structure in place that ends up costing them more than what it’s worth. Thoroughly weigh the options, consult with experts, and decide if it is worth it to create a DSO structure.